Canada’s headline inflation rate was 4.3% in March 2023, down from 5.2% in February and the lowest it has been since August 2021. This cooling is on the heels of decelerating growth in food and gasoline prices. The base effect is a contributing factor, due to a jump in fuel prices in March 2022 following uncertainty with Russia’s invasion of Ukraine. The base effect referring to the impact that the previous, lower base level (fuel prices in February 2022), has on the calculation month to month. Since our March base is higher, we expect to see a lower year-over-year inflation rate.

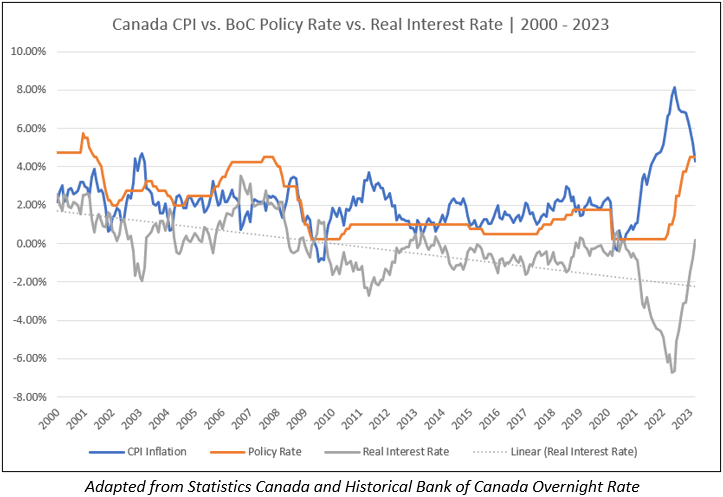

On a seasonally adjusted monthly basis, the CPI still rose 0.1%. As a result, the Bank of Canada did not increase their policy rate on April 12, 2023, but indicated that we could expect rates to stay higher for longer. With the policy rate holding steady and inflation decelerating, the Real Interest Rate is rising from the deeps of the pandemic and continuing upwards. The Real Interest Rate is defined as the nominal interest rate minus the rate of inflation to calculate the real risk-free rate of return. For the purposes of comparison, the Bank of Canada policy rate is used as the nominal rate.

Inflation occurs in an economy when the supply of money increases relative to the goods and services available in-said economy. If productivity increases relative to the money supply, there would be a deflationary effect. In our post-modern world of rapid innovation, governments have been able to expand the money supply and keep rates low without much concern as growth kept inflation at bay.

Looking at the Real Interest Rate (instead of the nominal policy rate) can help keep a macro perspective on the environment we are in. When the Real Interest Rate is negative, governments, companies and individuals can borrow and spend for projects with an edge. This edge is created because tomorrow’s money is slightly cheaper than tomorrow’s prices, so use tomorrow’s money at today’s prices.

However, as real interest rates rise the edge gets smaller. If real rates are positive, a project has a higher hurdle to overcome to be profitable.

We speak in absolutes here for simplicity, calculating the Real Interest Rate as the policy rate minus the headline inflation rate. Individuals and companies have internal variables that determine their individual Real Interest Rate. But as the pendulum swings in the model, it goes in the same direction for everyone, to varying degrees.

Over the last roughly 20 years we have seen a downtrend in real interest rates, with the majority of time spent below zero, giving tailwinds to spending and investment. We have now crossed the line into slightly positive territory after a deep trough. Investors have long-term time horizons, making them less sensitive to transitory swings. Since developments may take 2-3 years to reach the market, investors are banking on interest rates coming down over that period based on the progress thus far towards the Bank of Canada’s target inflation rate. This explains why market capitalization rates have not fluctuated widely in the recent high interest rate environment.

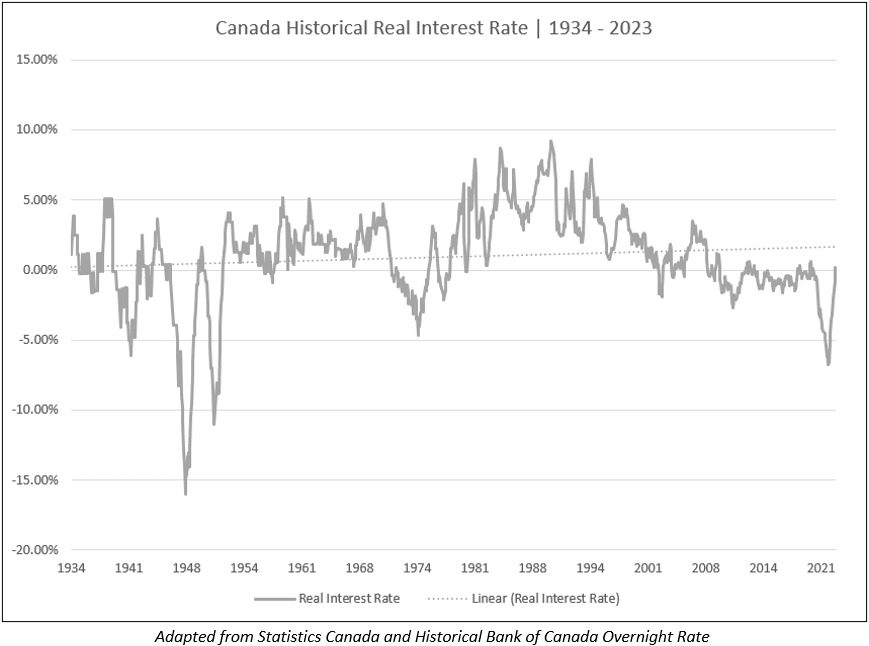

In the graph below, we can see that the Real Interest Rate has trended downwards since roughly 2000, which is in contrast to the overall trendline since 1934. It remains to be seen how the current climate with labor shortages, immigrations targets and overall indebtedness of citizens and governments will affect the Real Interest Rate. Higher government and private debt mean that the economy is more sensitive to interest rates than in previous cycles, which absorbed sustained periods of positive real interest rates.

Since November 2021, the rise in real interest rates has had an effect on equities, especially in the tech sector where stretched valuations have been brought back to earth by a higher discount rate. However, it will be slower to affect the real estate market. Historically, house price corrections in 1990 and 2008 were preceded by a period of higher real interest rates. In investment real estate, investors’ expectations of risk-adjusted returns (the risk-free rate plus investor risk premium) need to be satisfied for transactions to occur. If the Bank of Canada continues to hold a tight grip on higher rates in the face of lower inflation and keeps the Real Interest Rate in positive territory, we could see downward pressure on the real estate market to follow, all other things being equal. Conversely, if the Real Interest Rate is kept negative, there is upward pressure on the market. We’re hitting the inflection point now, time will tell.